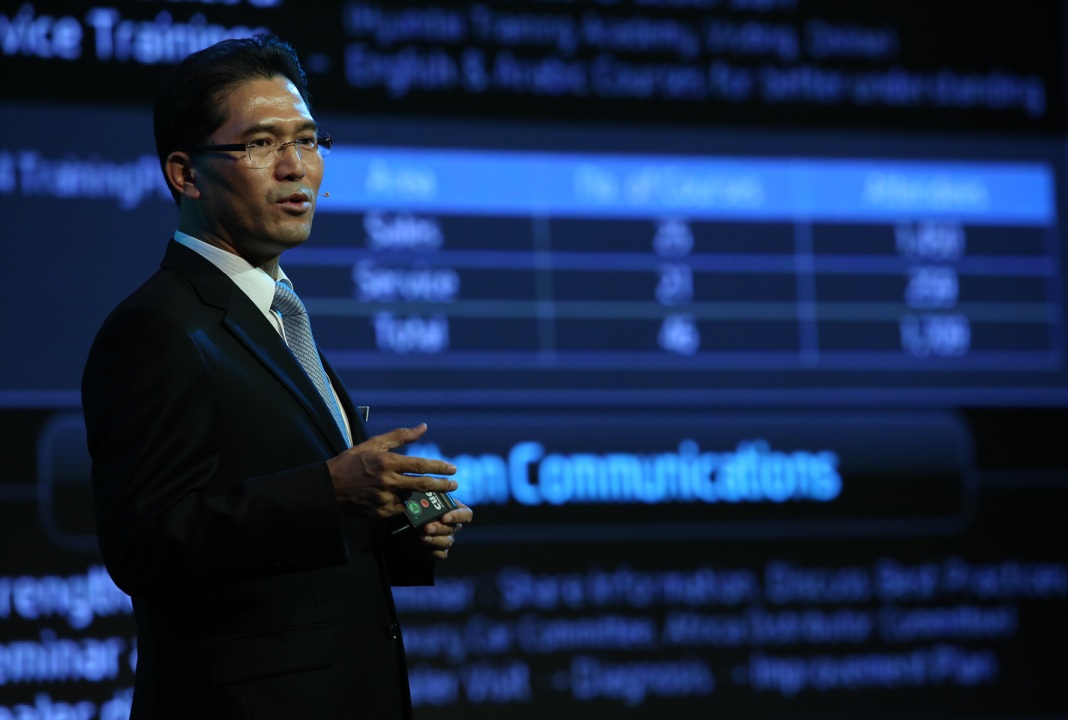

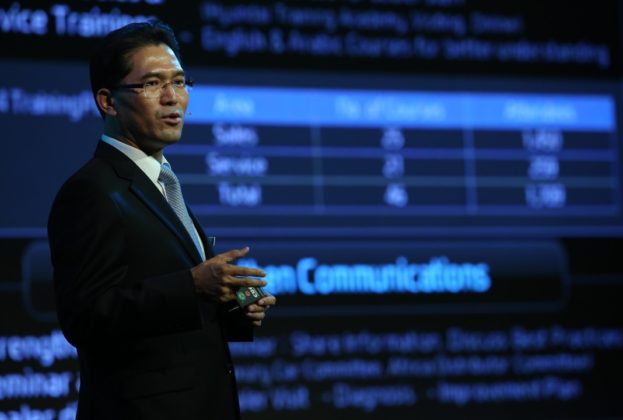

In a broad ranging interview with Head of Hyundai Africa and Middle East Headquarters, Tom Lee, we discuss the brand’s future prospects and how a stronger Won and weaker Yen might affect Hyundai’s recent sales and market share gains, and whether it Japanese rivals might claw back lost ground. Hyundai’s regional boss also explains the brand’s arguably more ambitious plans for its luxury Genesis and centennial models, and why a luxury sub-brand like Nissan’s Infiniti and Toyota’s Lexus hasn’t been established. Having recently held the new Sonata model regional launch in Jordan, Mr. Lee underlines Jordan’s position as Hyundai’s second largest regional market and the Middle East’s importance for Hyundai. GM: With an improved and good value product range, Hyundai group cars have shown a sustained and meteoric rise over recent years. To what extent has the global recession worked in Hyundai’s favour in this regard?

GM: With an improved and good value product range, Hyundai group cars have shown a sustained and meteoric rise over recent years. To what extent has the global recession worked in Hyundai’s favour in this regard?

TL: The global recession had a big effect on the majority of manufacturers across the globe, and Hyundai was no exception… Our success over recent years can be put down to hard work, producing quality vehicles, and providing an excellent level of customer service. One of our key strengths, both in the region and globally, is the extensive vehicle range that we offer to customers, meaning that we can cater to all needs.

Recently, customer confidence in these models has increased significantly and this has been helped by Hyundai’s pursuit of its Modern Premium brand direction. Our newest models provide class-leading standards of all-round quality, a fact that is reinforced by the numerous regional and international awards that our cars have received. This in turn has had a positive impact on sales and the popularity of Hyundai vehicles.

GM: Hyundai have not created a separate luxury sub-brand for the Genesis and Centennial models like Nissan and Toyota respectively created Infiniti and Lexus as defined luxury products. Can the Genesis and Centennial compete with established luxury brands with a Hyundai badge, or are they deliberately intended to raise brand equity and market positioning?

TL: At the current time, Hyundai is focusing on developing and improving our luxury car offering and the levels of service for our luxury customers, rather than investing in establishing a separate brand. By doing this, we can ensure that we continue to supply more affordable luxury cars to customers.

The Centennial and Genesis – which sell well across the global market – are key in demonstrating that Hyundai is able to produce cars that are equal to, or better than, the best in the world. They encapsulate the Modern Premium brand direction of Hyundai across the globe, and it is these models that have the ability to change customer perceptions about Hyundai as a brand.

GM: The new Genesis wears a rear Hyundai badge, but uses a new and distinctly luxury car-like be-winged emblem in front. Might this confuse people, or does this leave the door open for a possible Genesis sub-brand?

GM: The new Genesis wears a rear Hyundai badge, but uses a new and distinctly luxury car-like be-winged emblem in front. Might this confuse people, or does this leave the door open for a possible Genesis sub-brand?

TL: As mentioned, there are no plans to establish a separate luxury brand, and our luxury models will continue to operate under the Hyundai mother brand, which is why the Genesis wears a Hyundai badge. At the same time, we recognised what an important model the All-New Genesis is for us in terms of the Modern Premium brand direction and we took the decision to create an individual emblem also, as was the case for Centennial.

GM: Hyundai has recently re-entered the World Rally Championship as a factory works team for the 2014 season. Does this mean we should expect sportier performance production cars, perhaps an i20 hot hatch spin-off?

TL: It took a tremendous amount of hard work from everyone at Hyundai Motorsport to be able to launch the Hyundai World Rally Team, and it is something that we as a company are very proud of.

However, rather than developing cars with a sportier performance, our aim is to equip our GDI line-up to meet customer needs with regards to performance. In the Middle East market, we have already added a GDI engine for the Genesis, and it will also be applied to our Santa Fe, Veloster, Sonata and Genesis Coupe models in the near future. However, we have no plans for a spin-off performance car division at the current time.

GM: Hyundai’s collaboration with British sports car maker and engineering firm Lotus on the new Genesis’ chassis tuning seems to have been a success, as it drove with buttoned-down precision and fluency during its recent regional launch. Will we see more cooperation with Lotus, and does this signal a more European flavour at Hyundai?

TL: The collaboration with Lotus was applied only for the US specification Genesis, and was not part of the production process for the Middle East model. During the car’s development for the Middle East, a great deal of attention was paid to the performance, premium quality features and state of the art technology, in order to satisfy the needs of the discerning Middle East customers.

In customer clinics, research has shown that the Genesis is superior in every area to competitor models, and with its very competitive pricing, we believe that regional sales of the Genesis will register a year-on-year increase – something that we have seen every year since the original model was launched in 2008. GM: The high performance mid-engine Veloster Midship version of Hyundai’s sporty mid-size hatchback was quite the sensation at the Busan motor show and was reminiscent of the previous iconic Renualt 5 Turbo and Clio V6 models. Is there any chance Hyundai might produce such an iconic production version?

GM: The high performance mid-engine Veloster Midship version of Hyundai’s sporty mid-size hatchback was quite the sensation at the Busan motor show and was reminiscent of the previous iconic Renualt 5 Turbo and Clio V6 models. Is there any chance Hyundai might produce such an iconic production version?

TL: The Veloster Turbo hot hatch has already been very well received in other markets, and the aggressive re-styling of an already popular design is matched by the more powerful engine, and it is set to be a popular addition to the extensive Hyundai range.

Featuring a more powerful 1.6 Turbo GDI, capable of producing a maximum of 204ps horsepower and 27.0 kg.m of torque the new Veloster Turbo GDI can reach 100km/h in 7.4 seconds – 4.1second faster than a standard model Veloster.

Already available in Lebanon, Jordan and Syria, we plan to introduce the Veloster Turbo into GCC markets in September, and we anticipate it to be a major game changer, following its debut at the Dubai International Motor Show at the end of last year.

As far as the Midship version is concerned, this was obviously a concept model so therefore we are unable to say for sure whether it will be put in to production or not. With all Hyundai models, we will always strive to introduce a new vehicle if the market and customer demand is there.

GM: Hyundai has been somewhat reticent in introducing a broader range of its more efficient gasoline direct injection (GDI) engines to the Jordanian market, whereas Mercedes-Benz’ best-selling models use similar technology. Is this due do fuel quality issues, or will such engines disadvantageously increase costs and pricing structures?

TL: There are already plans in place to expand the Hyundai Turbo GDI engine line-up across the Africa and Middle East region, starting with the All-New Genesis, which was introduced in April this year. The highly-anticipated Veloster Turbo will also be available for production order from September 2014… and we believe it will make a popular addition to the extensive Hyundai range in Jordan.

There is obviously a price gap between the MPI and GDI engines. However, if there is increased demand from Jordanian customers for more performance orientated engines, then we will look to strengthen our GDI line-up in the country.

GM: Having overseen the introduction of a discernable, cohesive and successful Kia design identity since 2006, Peter Schreyer now holds the position of President and is also concurrently responsible for design at both Hyundai and Kia. Will this allow for a more focused approach to differentiating the two brands’ identities, or might this not lead to similar design language?

TL: Following his move to oversee the design identity for both Hyundai and KIA together, it became clear that the two brands can have more of a differentiation in terms of design. The Fluidic Sculpture design philosophy, for instance, is exclusive to Hyundai models, and is integral to our Modern Premium brand direction. The design identity has played a key role in establishing our reputation as a manufacturer of cars that feature great design, and has been received extremely well by our customers.

GM: Hyundai is now the world’s fifth biggest car maker. What are its market share and sales figures in the Middle East and Jordan specifically?

TL: Last year, the Middle East sold a total of 328,856 units, which represented an 8% increase over the previous year and meant that our sales topped the 300,000 mark for the second consecutive year. In the face of extremely strong competition from Japanese, European and American manufacturers, we maintained our number two position in the market, with a market share of around 16%.

In Jordan, we are fortunate to work with an excellent distributor partner; Unity Trading Establishment, who mirror the Hyundai company values, and our performance in the country is testament to their efforts. Jordan is key market for us regionally, and in 2013 it recorded sales of over 28,500 units, which represented around 9% of total sales in the Middle East. These sales also positioned Jordan as the second biggest Middle East market for Hyundai, second only to Saudi Arabia.

GM: Which are the most popular Hyundai cars in the region and Jordan and why?

GM: Which are the most popular Hyundai cars in the region and Jordan and why?

TL: For 2013, it was our compact cars that topped the sales charts, with the Elantra and Accent respectively proving to be the most popular models with Middle East and Jordanian customers. The Elantra overtook the Accent as the region’s favorite Hyundai model, recording sales of over 95,000; an increase of 29,000 on the previous year. The SUV line-up also continued to sell well, with the Santa Fe and Tucson both posting strong results in the Middle East, and selling over 3,000 units each in Jordan.

Our premium… flagship Centennial and Genesis models, are very important when it comes to demonstrating the level of luxury and refinement that Hyundai is able to produce, and both models recorded an increase in sales last year in the Jordanian market.

In the 2nd half of 2013, we also launched the Sonata Hybrid in Jordan. The model sold 800 units in 2013, and for 2014, sales are already over 750. There has been a tremendously positive reaction to the Hybrid model in Jordan.

GM: How would you account for Hyundai’s and Kia’s position as the best-selling car brands in Jordan?

GM: How would you account for Hyundai’s and Kia’s position as the best-selling car brands in Jordan?

TL: Hyundai maintained its number 1 position in Jordan in 2013, ahead of our Japanese competitors, with a 47% market share. Even with Toyota sales showing an increase in 2014, we are continuing to register a strong market share and are maintaining our number 1 position in the country.

When it comes to Hyundai models, one of our key strengths is the extensive vehicle range that we offer to customers in Jordan, meaning that we can cater to all needs. Recently, customer confidence in these models has increased significantly and this has been helped by Hyundai’s pursuit of its Modern Premium brand direction.

In keeping with one of the main objectives of Hyundai Motor Company, our partner Unity Trading Establishment delivers excellent levels of customer service, which have led to high levels of customer satisfaction. This has enabled us to build strong customer loyalty for the Hyundai brand – something that in turn has had a positive impact on sales figures each year.

GM: To what extent would Hyundai’s rising market position and a strong Won and weaker Yen affect its’ export market share and sales expansion in the long term. And what is Hyundai’s expected global growth for 2014, and how much do Japanese car makers stand to benefit?

TL: The global growth target for 2014 was 3.8% at the beginning of the year, and first half results have been positive, both globally and in our region. Total global sales for Hyundai in 2013 were 4.7 million units, and for 2014 the target is 4.9 million. For the first half of 2014, we registered sales of 2.36 million, which represents a year-on-year increase of 2.6%, which is a positive sign.

In order to combat the strong Won and the advantage that our Japanese rivals will get from the weakened Yen, we are focusing on improving the quality and design of our products further still, and ensuring that we deliver the very best in customer service across the globe.

The Middle East and Africa region is a key growth market for us, and we see it as the next driving force for Hyundai Motor Company on a global level.

GM: Would any resultant purchase price rises have an effect on a very price-sensitive high-tax car market such as Jordan, and would other mid-range brands stand to significantly cut into Hyundai’s market share in such an eventuality?

GM: Would any resultant purchase price rises have an effect on a very price-sensitive high-tax car market such as Jordan, and would other mid-range brands stand to significantly cut into Hyundai’s market share in such an eventuality?

TL: As with every market that we operate in, our aim in markets such as Jordan is to offer high quality products and reasonable prices. Competition across the region is becoming fiercer every year, but we believe that our customers are satisfied with our current price policy, and therefore do not anticipate any serious decline in market share across the Middle East.

GM: As a major global car maker, does Hyundai plans to establish more foreign-based production plants to reduce shipping or labour costs, or perhaps better respond to local and regional preferences, such as the Eon, built at the Chennai plant in India?

TL: Currently, Hyundai operates a total of nine production plants in eight countries, with each of these plants supplies high quality products to their neighbouring regions. We are always looking at how we can potentially expand the number of overseas production plants, however our number one priority is not to expand the volume of product that we produce. Instead, our focus remains on customer satisfaction.

At present we feel that our current production facilities are able to cater to the needs of the region, but that is not to say that we would not consider setting up additional production plants in the future if we felt that it was warranted. We carry out a great deal of regional research on the ground in key markets to ensure that the models available in those markets cater to the needs of the customers.

Recent Comments