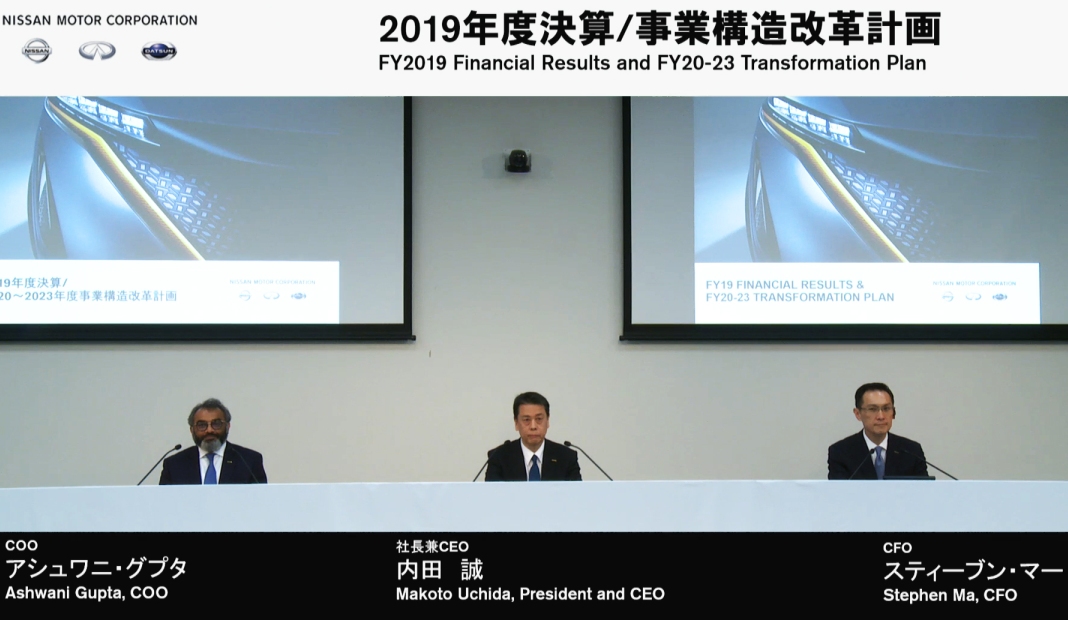

In the wake of global downturn in car sales for Nissan and the wider automotive industry in 2019, and worse yet projections expected for 2020 due to Coronavirus economic constrictions, Japan’s second biggest manufacturer has announced a restructuring and re-adjustment plan. A post-Carlos Ghosn plan put forth by Nissan CEO Makoto Uchida, Nissan’s rationalization and optimization plan seeks to ‘right-size’ Nissan, by reducing production and reducing its product by 20% in each case, and by focusing on sustained growth rather than inflated expansion.

Increasing plant utilization by 80% and reducing fixed costs, Nissan aims to consolidate its line-up to core models, with plant closures also on the cards in Spain and Indonesia. Intending to utilize its liquidity and Coronavirus crisis funding, Nissan will focus on core markets in Japan, China and North America, and will exit South Korea, streamline other markets and take its Datsun value brand out of Russia. Looking to invest more on electrification and driver assistance systems, Nissan will also focus on core segments including C and D segments and sports cars.

Press Release 1

Nissan unveils transformation plan to prioritize sustainable growth and profitability

28 May 2020, Yokohama, Japan – Nissan Motor Co., Ltd. today unveiled a four-year plan to achieve sustainable growth, financial stability and profitability by the end of

fiscal-year 2023. The scalable plan, involving cost-rationalization and business optimization, will shift the company’s strategy from its past focus on inflated expansion.

As part of the four-year plan, Nissan will take decisive action to transform its business by streamlining unprofitable operations and surplus facilities, alongside structural reforms. The company will also reduce fixed costs by rationalizing its production capacity, global product range and expenses. Through disciplined management, the company will prioritize and invest in business areas expected to deliver a solid recovery and sustainable growth.

By implementing the plan, Nissan aims to achieve a 5% operating profit margin and a sustainable global market share of 6% by the end of fiscal year 2023, including proportionate contributions from its 50% equity joint venture in China.

Makoto Uchida, Nissan chief executive officer, said: “Our transformation plan aims to ensure steady growth instead of excessive sales expansion. We will now concentrate on our core competencies and enhancing the quality of our business, while maintaining financial discipline and focusing on net revenue per unit to achieve profitability. This coincides with the restoration of a culture defined by “Nissan-ness” for a new era.”

The four-year plan is focused on two strategic areas, building on Nissan’s reputation for innovation, craftsmanship, customer-focus and quality, alongside an ongoing cultural transformation:

The four-year plan is focused on two strategic areas, building on Nissan’s reputation for innovation, craftsmanship, customer-focus and quality, alongside an ongoing cultural transformation:

1) Rationalization: robust actions to restructure, reduce costs and improve efficiency

Actions:

- Right-sizing Nissan’s production capacity by 20% to 5.4 million units a year under the assumption of a standard shift operation

- Achieving plant utilization rate above 80%, making operations more profitable

- Rationalizing the global product line-up by 20% (from 69 to fewer than 55 models)

- Reducing fixed costs by approximately 300 billion yen

- Intend to close Barcelona plant in Western Europe

- Consolidating North American production around core models

- Closure of manufacturing facility in Indonesia and concentrating on Thailand plant as single production base in ASEAN

- Alliance partners to share resources, including production, models, and technologies

2) Prioritizing core markets and core products

Actions:

- Focusing Nissan’s core operations in the markets of Japan, China and North America

- Leveraging the Alliance assets to maintain Nissan’s business at appropriate operational level in South America, ASEAN and Europe

- Exiting South Korea, the Datsun business in Russia and streamlining operations in some markets in ASEAN

- Focusing on global core model segments including enhanced C and D segment vehicles, electric vehicles, sport cars

- Introduce 12 models in the next 18 months

- Expanding presence in EVs and electric-motor-driven cars, including e-POWER, with more than 1 million electrified sales units expected a year by end of FY23

- In Japan, launching two more electric vehicles and four more e-POWER vehicles, increasing electrification ratio to 60% of sales

- Introducing ProPILOT advanced driver assistance system in more than 20 models in 20 markets, targeting more than 1.5 million units to be equipped with this system per year by the end of FY23.

Uchida concluded: “Nissan must deliver value for customers around the world. To do this, we must make breakthroughs in the products, technologies and markets where we are competitive. This is Nissan’s DNA. In this new era, Nissan remains people-focused, to deliver technologies for all people and to continue addressing challenges as only Nissan can.”

Press Release 2

Nissan reports financial results for fiscal year 2019

28 May 2020, Yokohama, Japan – Nissan Motor Co., Ltd. today announced financial results for the 12-month period ended March 31, 2020.

The global COVID-19 pandemic substantially impacted Nissan’s production, sales and other business activities in all regions. The impact is reflected in Nissan’s financial results for fiscal year 2019.

In fiscal year 2019, consolidated net revenue declined to 9.8789 trillion yen, resulting in an operating loss of 40.5 billion yen and a net loss1 of 671.2 billion yen. This includes costs associated with restructuring and impairments by 603.0 billion yen as Nissan focused on operational and efficiency improvements to transform the business. Free cash flow for the automotive business was a negative 641.0 billion yen.

Nissan maintains sufficient liquidity to steer through this challenging business environment. At year-end, cash and cash equivalents for the automotive business totaled 1.4946 trillion yen. Automotive net cash was 1.0646 trillion yen. In addition, the company continues to have access to approximately 1.3 trillion yen in unused committed credit facilities. In response to the COVID-19 pandemic, Nissan raised an additional 712.6 billion in funding between April and May.

Full-year financial results

The following table summarizes Nissan’s financial results for the 12-month period ended March 31, 2020, calculated under the equity accounting method for the group’s China joint venture.

On a management pro forma basis, which includes the proportionate consolidation of results from Nissan’s joint venture operation in China, operating profit was 116.7 billion yen, which equates to a 1.0% operating margin, and net loss was 671.2 billion yen.

Overall market demand decreased amid the current global environment, which has resulted in a slowdown in global total industry volume (TIV).

In fiscal year 2019, the global TIV fell by 6.9% to 85.73 million units. Nissan’s sales dropped 10.6% to 4.93 million units, and market share maintained 5.8% as per previous forecast.

2020 Outlook

For fiscal year 2020, Nissan anticipates the global TIV to decline by approximately 15 to 20% compared with the previous year due to the COVID-19 pandemic. Nissan’s management continues to evaluate the impact of the pandemic on our operations and will issue the fiscal year 2020 forecast when a reasonably calculated outlook is available.

Recent Comments